What is a Returning User?

Many of our clients within the gaming or gambling sectors, have KPIs that are focused on ‘new users’ instead of ‘returning users’, and only run Search Ads campaigns targeting users who have never downloaded the app. Therefore, why should they spend their Search Ads marketing budget on a returning user campaign, if it’s not going to help achieve their KPI targets and instead burn through their budget?

Before we explore some compelling evidence for targeting returning users, first let’s outline the audience. A returning user on Search Ads is any user that has previously installed the app – they may have installed it in the past, but since deleted it; they may have the app installed on another device, or they may have it on their main device but have not used it for some time.

Targeting returning users is a re-engagement and win-back opportunity – re-downloads make up a huge percentage of installs: 40%-60% of social casino apps!

This fact alone should encourage app owners to consider allocating App Store marketing budget to engage returning users. But if acquiring new users is your overall KPI, how does this idea benefit overall performance?

What is a Tap Through Rate (TTR) and Why is it Important?

Tap Through Rate (TTR) is an extremely important metric in Search Ads. TTR is when a user is delivered an impression of your ad and proceeds to tap it, to be shown your app store listing. A high TTR is a great indicator that Apple’s algorithm finds your app relevant to users who are searching with specific terms. A consistently high TTR on these specific search terms will enable you to win more impression shares on your ad, versus your competitors.

Returning user campaigns typically have a higher TTR than new user campaigns – this is because the user recognises and trusts the brand, since they’ve installed the app before. So whether the Search Ads campaign is for brand or generic keywords, the overall TTR performs well because of this brand familiarity and in turn, this improves the app’s performance within the Apple algorithm and allows more impressions to be served.

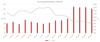

The chart below shows data from a social casino app with a target of delivering 7-day ROAS from new user campaigns only. Using the hypothesis above, we ran an objective test in the USA, setting up campaigns only targeting returning users, but using the same keywords as employed for new users (brand and top performing generic and competitor keywords).

As shown above, our hypothesis proved out. We set live the returning user campaign and as a result we saw TTR increase from around 15% to 25%. This allowed use to generate higher volume of taps and subsequently installs, so our CPI dropped from $12.00 to $6.00.

This was an achievement, however as their main KPI was Day 7 ROAS, we had to monitor the effects on that too, keeping our eyes on the client’s top performing branded keyword, as this generated consistent revenue.

Our observed data demonstrated that Day 7 ROAS increased from around 10% (pre returning user campaign) campaign, to around 20% (post). This very positive result unlocked additional budget for returning user targeted activity in all the territories where the client’s Search Ads campaigns were live on our Platform.

But How Did it Improve ROAS if Their Main KPI is to a New User?

The returning user campaign allowed us to acquire users at a much cheaper cost than previously achieved – the overall investment required was lower and therefore the revenue required to hit the Day 7 ROAS KPI was lower.

An additional explanation to the improvement in ROAS is although the user is a returning user, they may not have made a first purchase when they initially installed the apps, before going on to deleting it. Therefore, this purchase will be still counted as a first-time purchase and will be contributing to the improvement in ROAS.

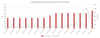

These results are compelling, but if you’re still not convinced, let’s consider that if a brand chose not to run a returning user campaign on its branded keywords, the door would be wide open for competitors to do so, and at a cheaper Cost Per Tap (CPT). As shown above, when the social casino app only ran new user activity, the highest Share of Voice (SOV) achieved for their branded keywords was 40-50%. Adding returning user targeted activity raised SOV to 70%+ on branded keywords. This is protecting your brand ad space from competitors, mitigating the potential loss of users to your competitors.

In conclusion, we improved the client’s overall performance in the App Store by running objective activity targeting returning users; we achieved a lower CPI, higher SOV, improved Day 7 ROAS and protected the client’s brand keyword from competitor bidding - or at the very least, increased the CPT to the competitor.